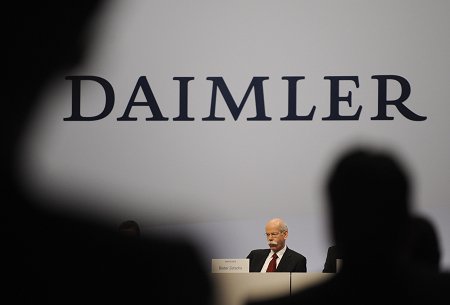

Daimler renunciation of NYSE joint venture business in China and proximity

Business Daily News (blue ZhaoHui) Germany car manufacturers Daimler companies in this year's exposure is very frequent. Since April, because bribery case to United States Government payment 1.85 billion settlement fee, Daimler company recently decided to apply for the company's delisting from the NYSE stocks. However, Daimler said, this does not affect its business and corporate financial chain.

In addition to the notifications NYSE, Daimler also will provide the United States Securities and Exchange Commission filing applications for delisting. Typically, from submission of application to the final approved 10 business days.

Daimler company will this decision from the NYSE delisting, summed up in the recent period of time, Daimler shares in the United States market trading volume downturn. But once the application for entry into force of the delisting of Daimler, the company also will provide the United States Securities and Exchange Commission for cancellation of all regulatory authorities registered securities and terminate their reporting obligations.

The industry believes that although the United States Government-related allegations against Daimler adverse effects do exist, but spend 1.85 billion for Daimler is not a major injury. Only the cost of further suppressing Daimler in capital market profit space, with a view to enhancing the Organization's overall profitability, Daimler delisting from the NYSE has also become helpless choice.

Automotive analysts believe that transnational corporations are optimistically expected to own stock will be affected by global investor's favor, but the transnational enterprises overseas stock trading volume of dropped or description for local investors do not have more attractive.

It is understood that in 2007, China's brilliance automobile also in the New York Stock Exchange delisted from the United States have been unable to investors that basically no integration to employers. Data show that brilliance automobile in 2006 most of the time trading volume less than 3 million shares. Trading volume downturn makes listing exists in name only, select the best delisting is not taken but which does not lose his head. While in New York on delisting and has no effect on ordinary shares continue to brilliance auto HKSE trading of listing.

Delisting from the NYSE Daimler selects another reason is to reduce the complexity of its financial reporting, but also to reduce their administrative costs and fees. For Daimler, this also means that the delisting from the NYSE, the company reduced its trading market volume of work completed. It is understood that Daimler opt-NYSE will save a significant amount of the annual fee and listing of maintenance costs.

Current Daimler in China and set up a joint venture passenger car North, and in 2007 and Fu steam joint venture to produce commercial vehicles. Prior to this , and BYD company announces joint venture to build a new brand of electric vehicles. This delisting from the NYSE does not ban investors worried about the future financing of Daimler.

responsible for China business of Daimler companies, Daimler in Northeast Asia, from NYSE exit and do not involve global automotive business. While Daimler company is expected this year in China's sales volume will exceed 10 million units. In addition, Daimler also in France and Germany in securities markets, the United States shareholders can continue to select in the large Bank and Frankfurt or Stuttgart stock exchange transactions.In fact, the difficult-to-market process now select withdraw from the back, it is for operational costs. According to professionals, our enterprise in the United States through IPO listing the average cost of up to 15%, so high cost many has achieved overseas listing of businesses pay excess. Experts believe in this, enterprises listed overseas in the decision, you must do the costs and benefits analysis, financing for the 10 million Yuan within enterprises overseas stock markets is not cost-effective.

(Business)